Homes and Condos for Sale and Rent in Miami

Integrated Services 360° 360°

Our apartments portfolio

Our houses portfolio

Projects in Orlando

Find your property in Miami

We have a wide portfolio of properties that are perfect for you

2,000 clients from around the world have invested in Miami thanks to PFS

22 years of experience in property sales in the United States

Our long-standing track record as leaders in the Miami real estate market positions us as your best choice. We have a proven track record that backs our reliable service and successful results.

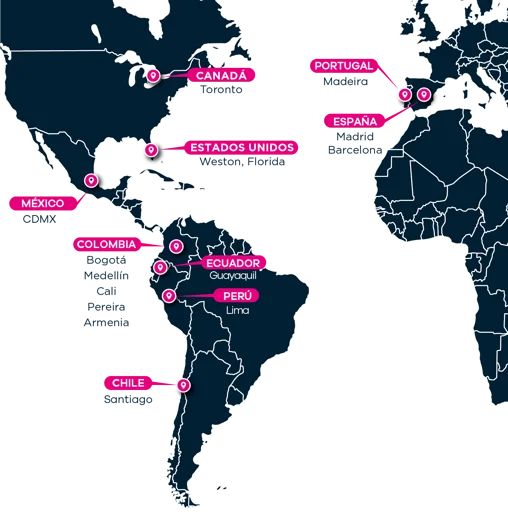

65 advisors in 12 countries in the Americas and Europe

A wide network of 65 advisors strategically located in the Americas and Europe to maximize your real estate investment opportunities.

More than 2,000 satisfied customers trust us

With an international network of agents, we offer global and localized perspectives that enhance our ability to find unmatched opportunities. From advice to closing the deal, we optimize your real estate investment opportunities.